Yes, you can travel (almost) for free. No, it’s not a scam. Yes, lots of people are doing it (including me). And yes, you can too. Here’s how it works:

1. Credit card companies like Chase and American Express want your business, because they make money each time you use a credit card (even if you don’t carry a balance — and you shouldn’t).

2. To get your business, these companies often pay you a sign-up bonus when you apply for a new card.

3. Then to encourage you to keep using their card, they pay you additional bonuses in the form of continuing incentives.

4. For reasons that aren’t clear (to me, at least), these bonuses usually take one of two forms:

- cash back — commonly a rebate of about 1.5 percent on everything you charge; or

- airline miles and hotel points.

The airline miles and hotel points are where things get interesting, because they are a short cut to travel you might not otherwise be able to afford.

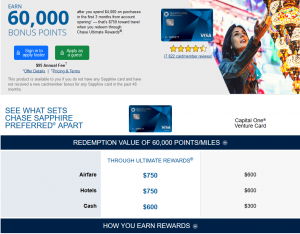

For example,* if you sign up for the popular Chase Sapphire Preferred credit card and spend $4,000 on it in three months, Chase will give you 60,000 Chase points, which can in turn be transferred to a variety of airlines and hotels.

How about London? Virgin Atlantic — another Chase partner — will fly you across the pond and back for between 20,000 and 45,000 miles, depending on when you travel and where you start.

You can even fly all the way to New Zealand for only 40,000 United miles. (But you’ll need another 40,000 to get back.)

[These numbers were correct when this summary was written, but they change often.]

[These numbers were correct when this summary was written, but they change often.]

Many people, myself included, prefer to use points and miles to fly business class. I’ve been to the six inhabitable continents, and on long flights — like the 15 hours between New York and South Africa, or the staggering 20 hours between New York and Australia — the difference between business and coach is the difference between enjoying your trip and swearing you will never again set foot on an airplane.

Credit cards have got you covered here, too. For about 200,000, you can fly in business class between almost any two spots on earth.

Now, 200,000 miles may sound like a lot, but it’s not really. Sign up for a few credit cards and you’re good to go!

Credit cards give you hotel points in much the same way that they give you airline miles. Chase points, for example, can be transferred to Hyatt, Marriott, and other hotel chains. And some hotels have their own co-branded credit cards to help you up your balances.

Four things you should always keep in mind:

- Mostly, don’t charge more than you can pay off. Ever. Not even once. It’s just not worth it.

- Signing up for credit cards is unlikely to have a long-term negative effect on your credit score (see below), but it can have short-term impacts. So if you’re anticipating a major financial deal like buying a house, you may want to wait before singing up for credit cards.

- Even a plan that is right for most people might not be right for you. Make sure you understand what you are doing.

- The fourth thing is the same as the first: Don’t charge more than you can pay off.

There are a variety of nuances you’ll want to investigate — different kinds of points and miles, annual fees on credit cards, taxes on award tickets, and so on. And I encourage you to look into all of those. It will probably take you less than an hour.

But if you really want to get started right now, here’s a suggestion that’s appropriate for many people:

- Do not charge more than you can pay off, no matter what. Ever.

- Sign up for the Chase Sapphire Preferred card and be sure to spend $4,000 on it within the first three months.

- Sign up for the Chase Freedom Unlimited and put $500 on it within the first three months.

- Once you’ve hit those thresholds — $4,000 for the Sapphire and $500 for the Freedom Unlimited — charge everything to your Freedom Unlimited (because it gives you 1.5 points for each dollar you spend) except charges that are:

- travel related, like flights, rental cars, hotels, etc. (because the Preferred gives you 2 points for each dollar on these)

- at restaurants (again because the Preferred gives you 2 points for each dollar on these)

- outside the country (because the Unlimited charges an extra fee on international charges)

Do this and you’ll have at least 80,000 Chase points after three months.

If you tend to charge about $1,500/month on credit cards, you’ll have between 92K and 101K points a year from now, depending on what you spend your money on.

If you tend to charge about $3,000/month on credit cards, you’ll have between 119K and a whopping 137K points a year from now, again depending on your spending pattern.

For your first year, this won’t cost anything in fees. Each year after, you’ll pay a $95 annual fee for holding the Preferred card.

You might think that signing up for credit cards will hurt your credit score. But — at least in the long run — it usually works the other way around, because a significant part of your credit score reflects your unused credit. The more credit you have unused, the better your credit score.

There are other factors, of course, including how recent your credit is and how many cards you’ve applied for recently. So in the short run, your credit score may take a small hit.

The basic strategy here isn’t complicated.

- You get as much as you can in sign-up bonuses. (This is the real jackpot.)

- You get as much as you can for each dollar you charge. (This can add up faster than you think.)

- You minimize your costs, primarily annual fees.

But there are enough nuances that it’s worth poking around. For example:

- You won’t be approved for every card you want. In particular, Chase — which often has the most lucrative offerings — will only approve you for most cards if you haven’t already opened five cards in the past two years. Other banks have similar, sometimes murkier, limitations.

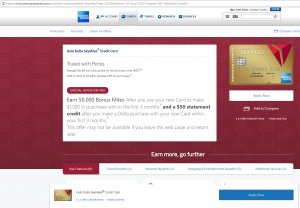

- Some card issuers like American Express will generally only give you a signup bonus for a card that you have never had before.

- Credit cards often run specials with augmented signup bonuses. For example, I got in on a 100K signup bonus for the Chase Sapphire Reserved. That deal is gone, but you never know what lurking around the corner.

- Not all points are equal in value. Hilton points, for instance, are generally worth less than $0.005 each. (That’s less than half a penny.) Chase points can be worth four or five times that. What you can get for Delta points depends on what you’re trying to do. And so forth.

- Even points that are equal in principle might not be equal to you.

All of this means that poking around can be very rewarding. I’ve got suggestions below.

Once you realize how much you can earn just for putting something on credit card, you’ll want to charge everything you can. Some of this is easy: Everything you used to put on a debit card you’ll now charge. You’ll try not to use cash. You’ll charge things on-line instead of debiting your checking account. When you dine with friends, you’ll offer to take cash from your dining companions and then charge the whole meal. And so forth.

At some point you’ll start to wonder if there are ways to increase your credit-card charges even more. And there are. Google “manufactured spend,” and plan to spend a bit of time reading.

There are blogs devoted entirely to helping you make the most of your credit card spending. I especially like The Frequent Miler because of its honest approach and detailed, reliable information. (I also write for the Frequent Miler a couple of times a year.)